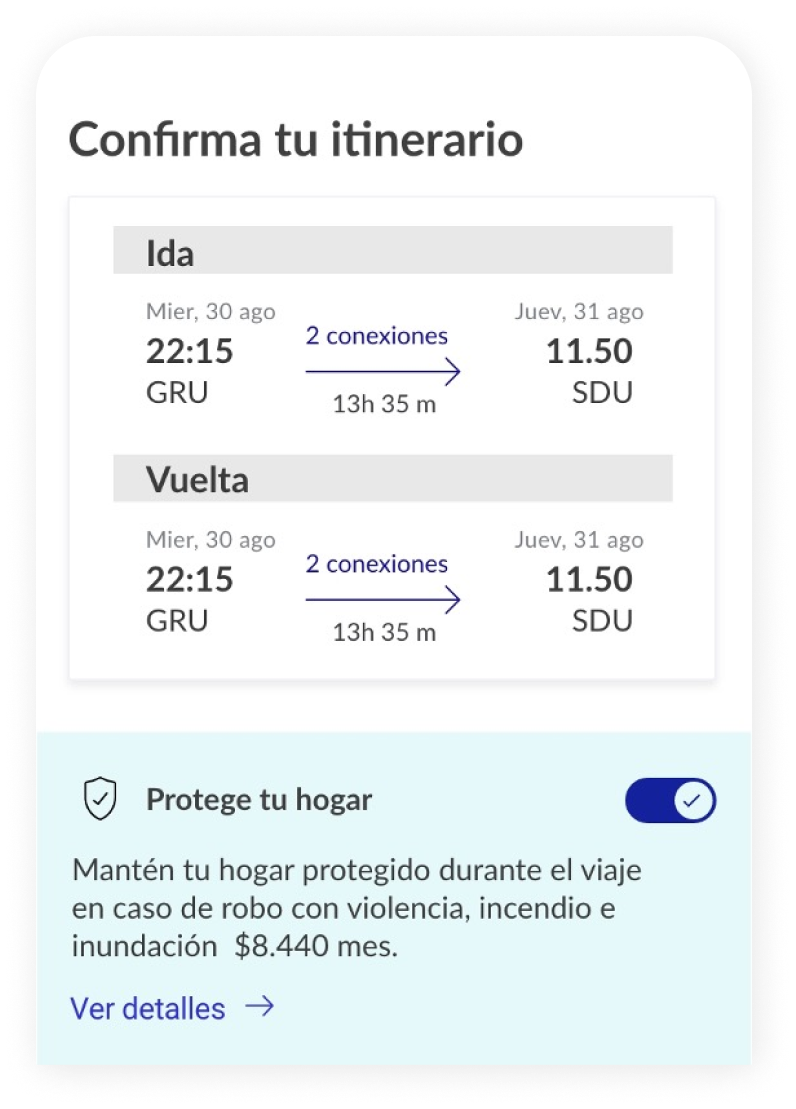

Insurance that covers accidents resulting in permanent disability or death, cash is transferred to either the customer or their dependents.

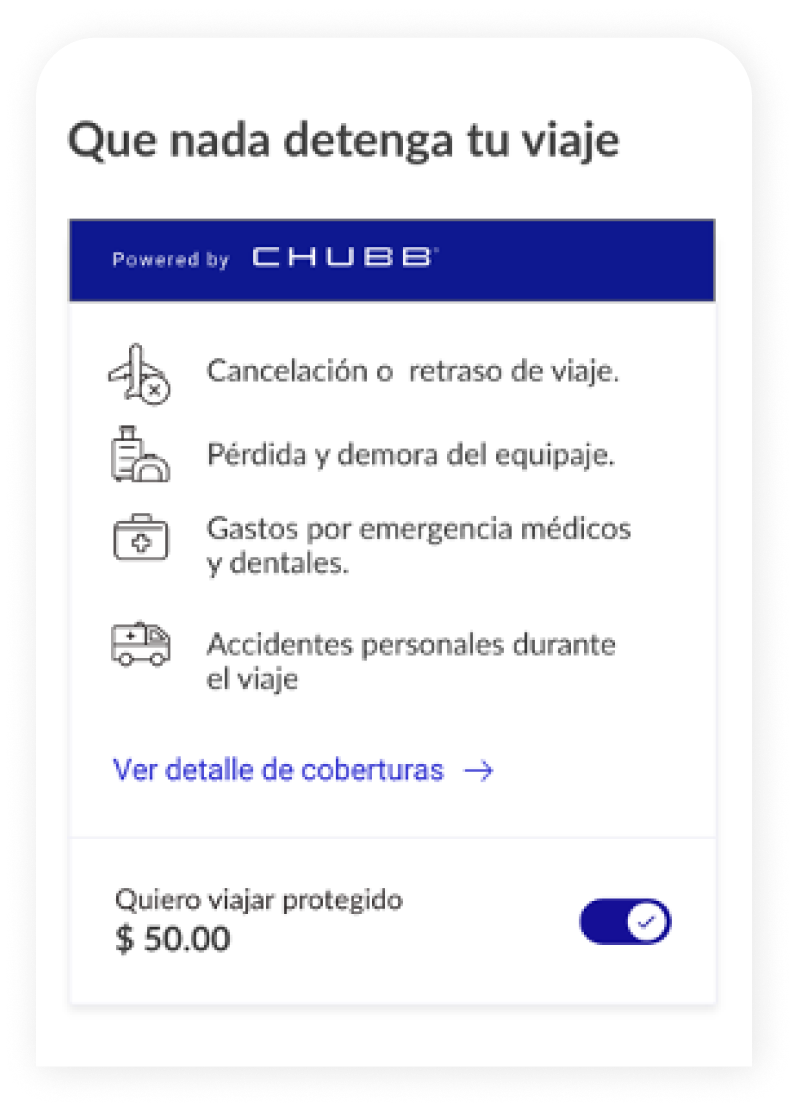

Essential cover that's integral to ensuring customers are still able to fulfil their essential bill payments in tough times

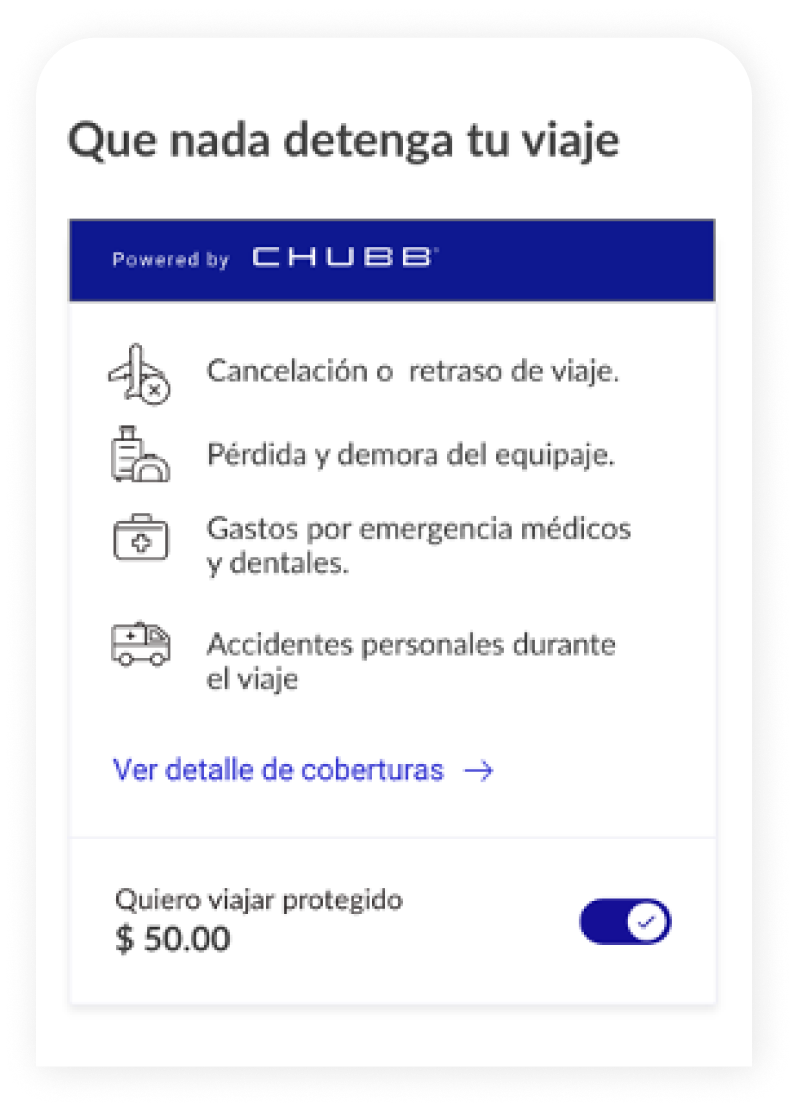

Relevant proposition at the point of bill payment to increase awareness and consideration for protection

Claims paid into customer or dependent bank account