APIs

While Chubb Studio offers multitude of options for partners to integrate with our products and services, APIs remain one of the most widely used integration method. Chubb Studio APIs are available across the entire insurance lifecycle and cater to countless use cases for products, pricing, distribution, servicing, claims & utilities.

Chubb Studio's APIs are exposed and hosted in the cloud – we make use of API management gateway to provide our partners with a secure and stable platform. APIs and respective backend services are fully cloud native supported by dedicated in-house cloud and network engineering teams, along with support from our designated cloud service providers.

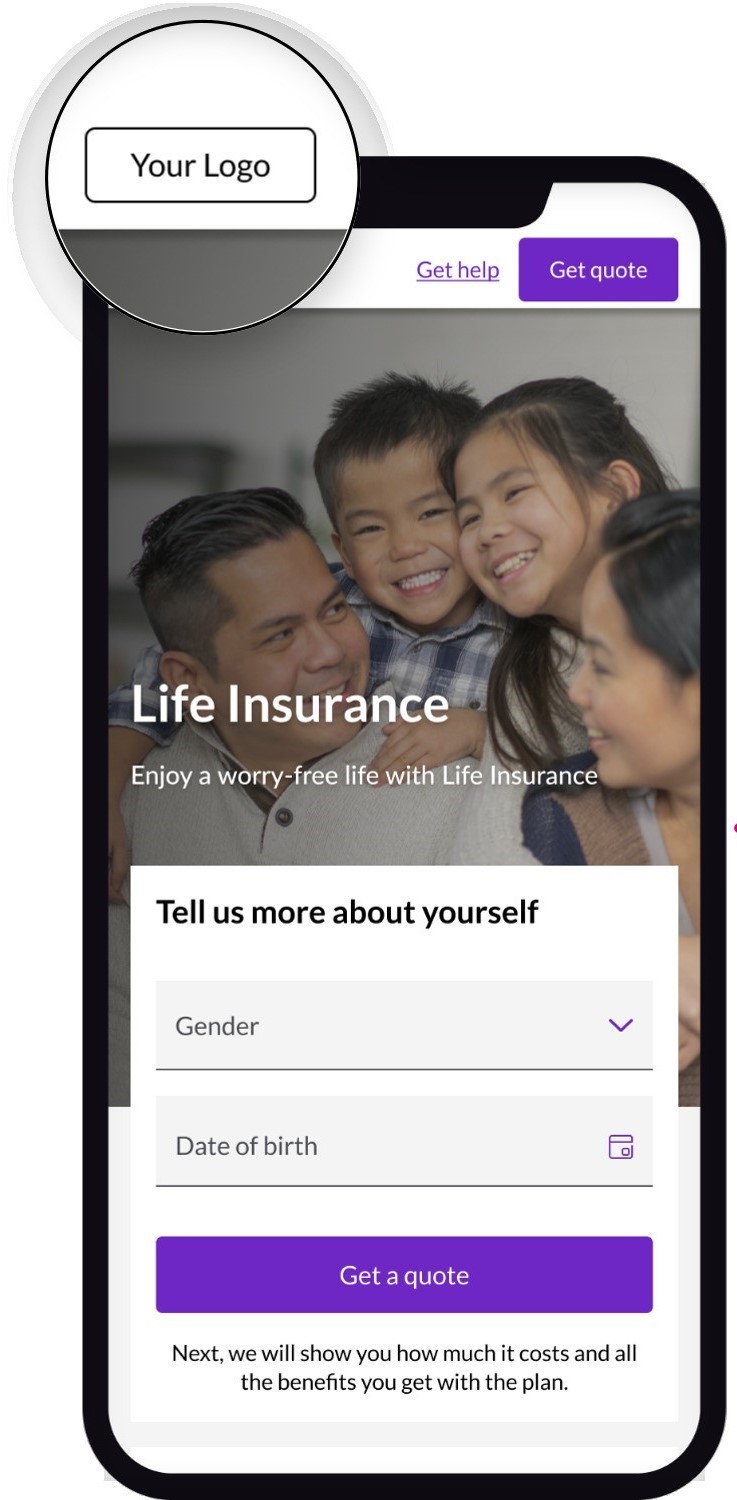

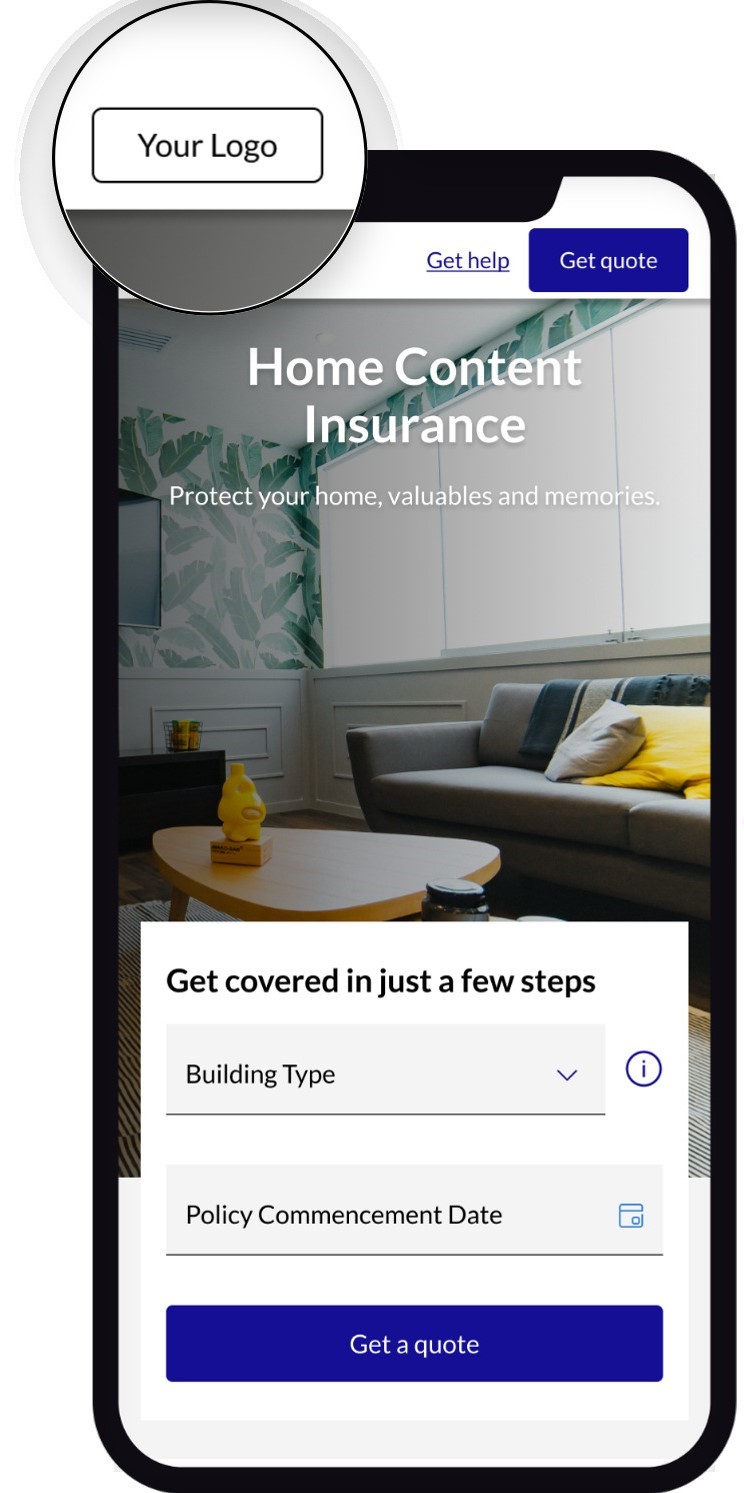

Our RESTful API suite offers a standardized set of functions across the entire insurance lifecycle, allowing partners to customize their brand integration in insurance journeys. These APIs provide full control to partners in delivering insurance products and services.

API standards

Security

Quality Assurance

Validation schema:

Performance

Logging:

Insights

API lifecycle

Chubb Studio's APIs are structured around the insurance lifecycle and value chain.

Chubb empowers their partners to integrate/consume/embed insurance products nd services within their own ecosystem with dedicated APIs and end points

Click on each phase or feature to discover more

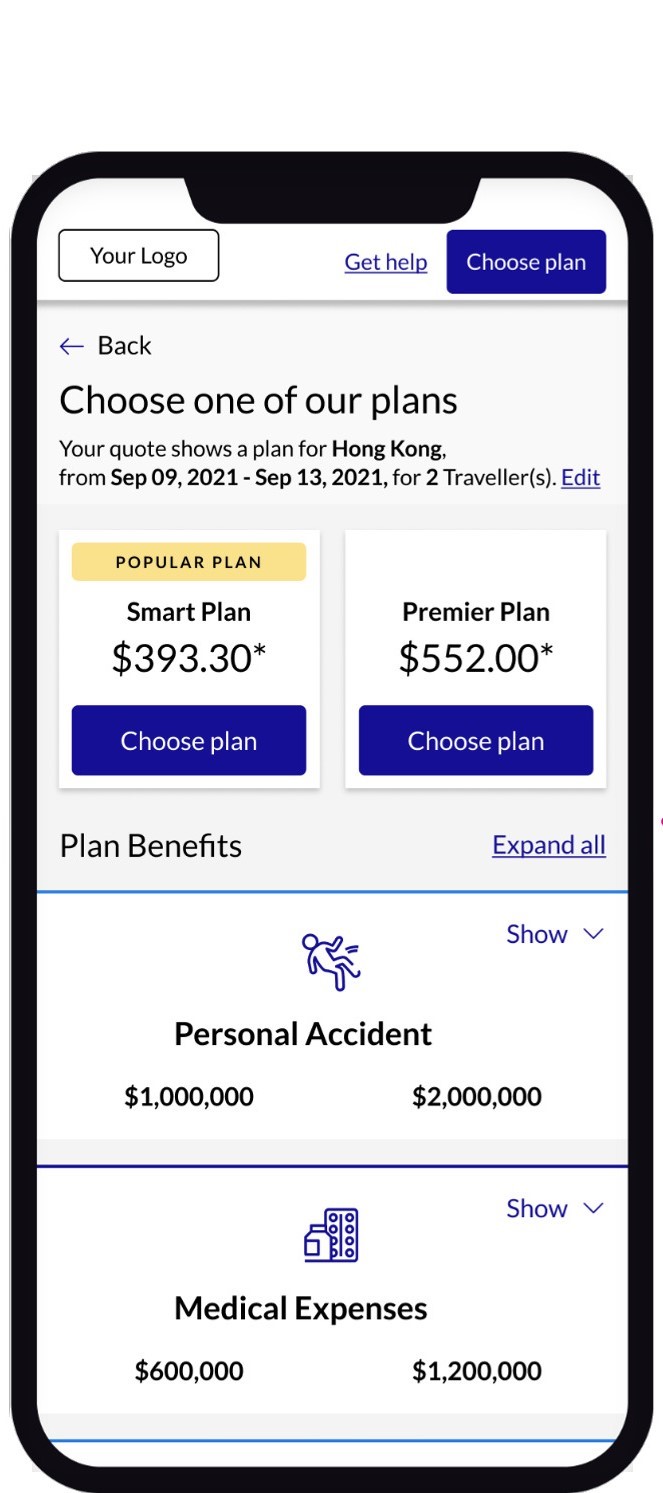

Discovery

Discovery

Insurance products available at their disposal for distribution.

Product information

a. Product description b. Benefit levels c. Coverage details d. Premiums, etc. e. Pricing specificsWhat is the API value proposition?

- Empowers partner’s discovery process by providing a clear summary and details of various products, including their benefits/coverages, sum insured limits, pricing questions, exclusions, documents, and other details typically associated with a product.

- Helps partners to decide which product proposition to offer to their customers.

- Helps partners to understand the various placeholders required to demonstrate the product proposition on their UI/customer journey.

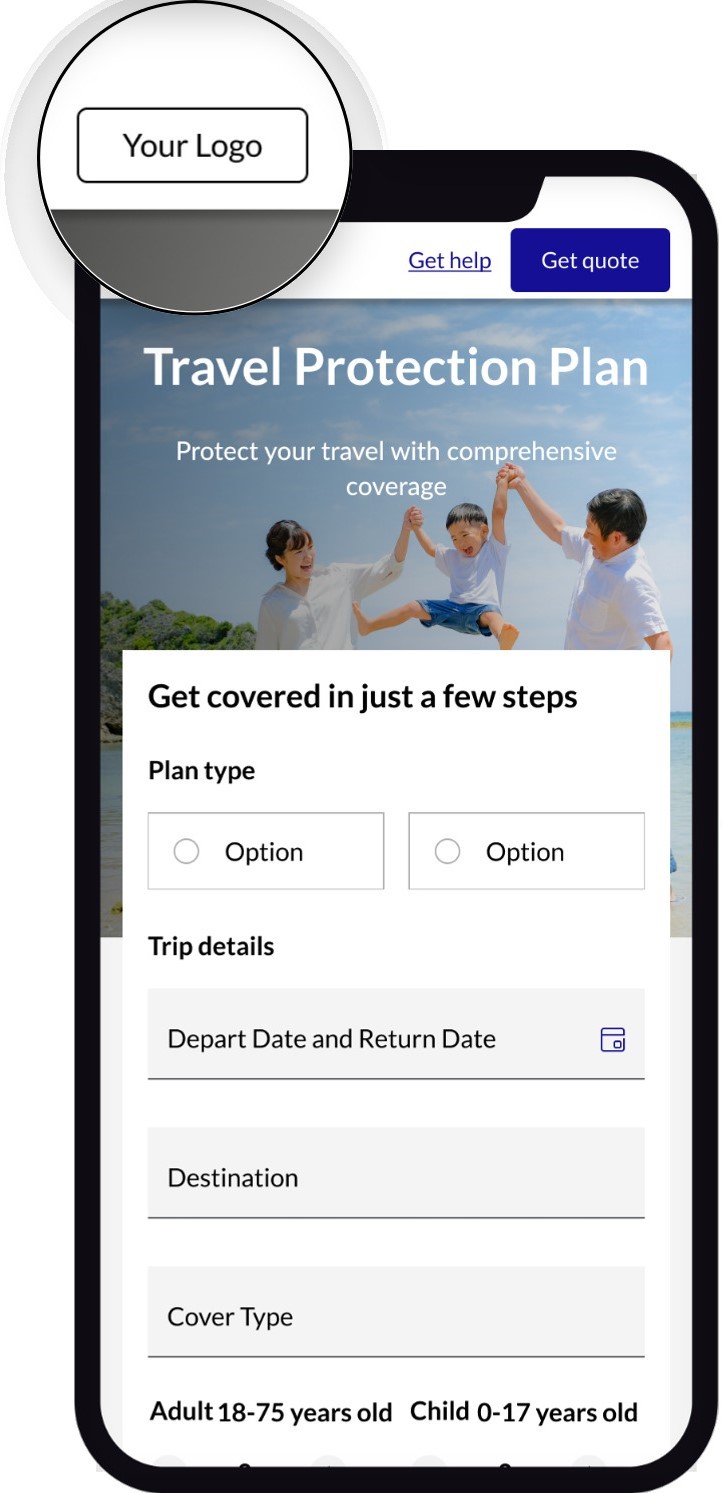

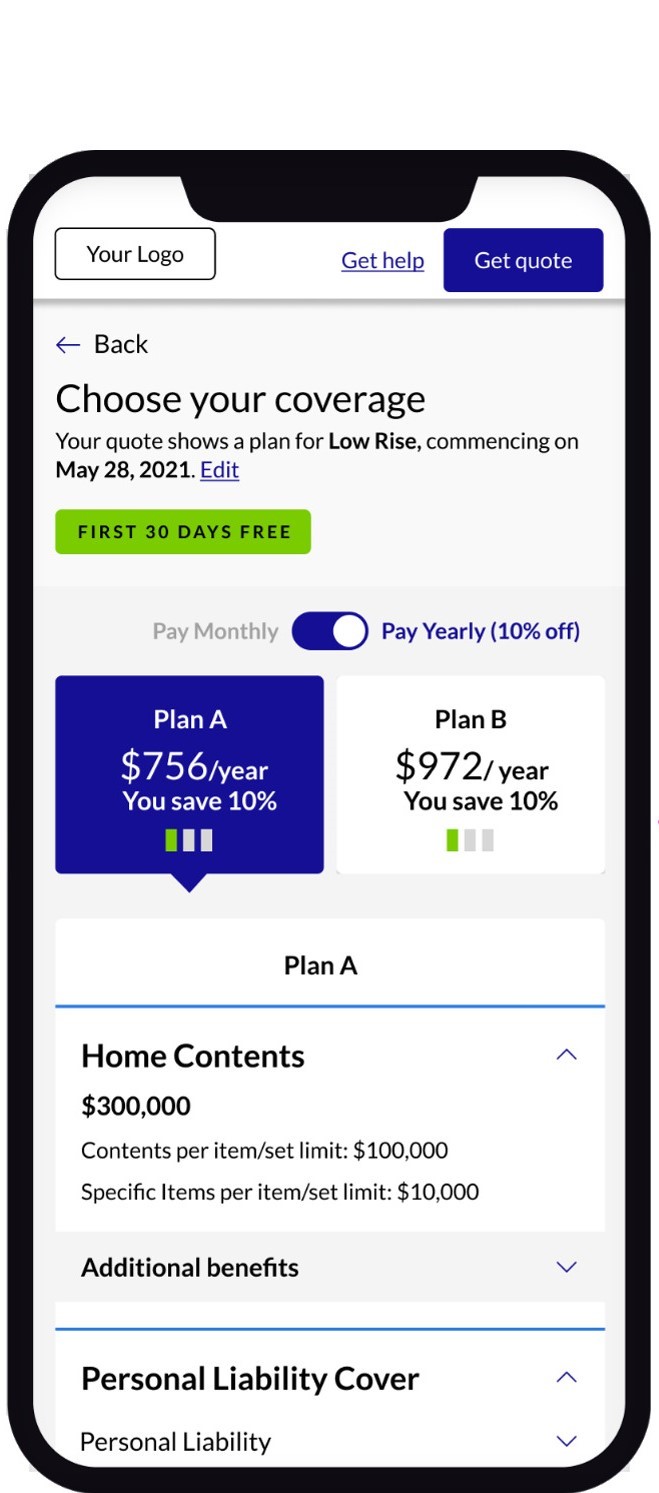

Pricing

Pricing

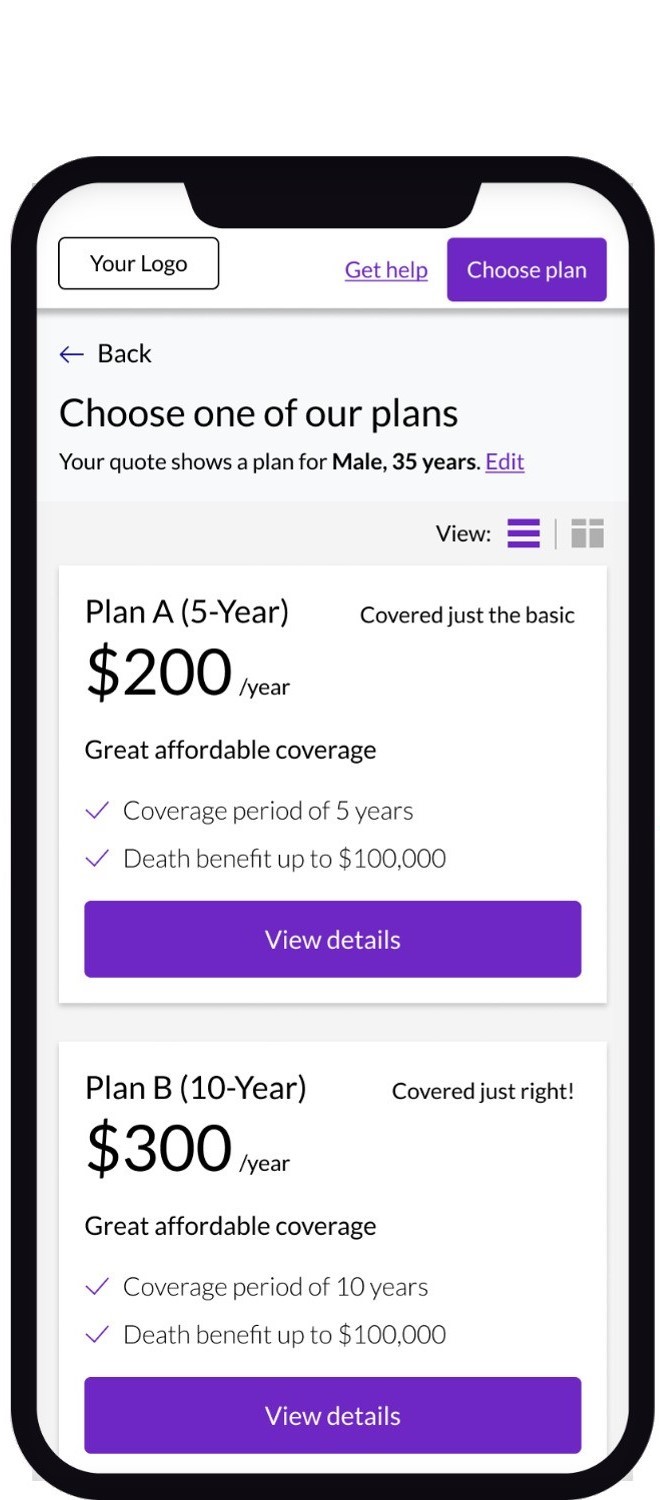

Provide the ability to request pricing for a specific product or a set of products by providing the necessary parameters (in the form of question/answer pairs and/or other inputs as required).

What is the API value proposition?

- Deliver the pricing/costs associated with a particular product(s)/proposition(s)

- Enhance the distribution experience by providing real time pricing for different coverages and services. Deliver one of most critical aspect of the insurance proposition – pricing, thereby helping customers select the best options for their insurance needs

Sales

Sales

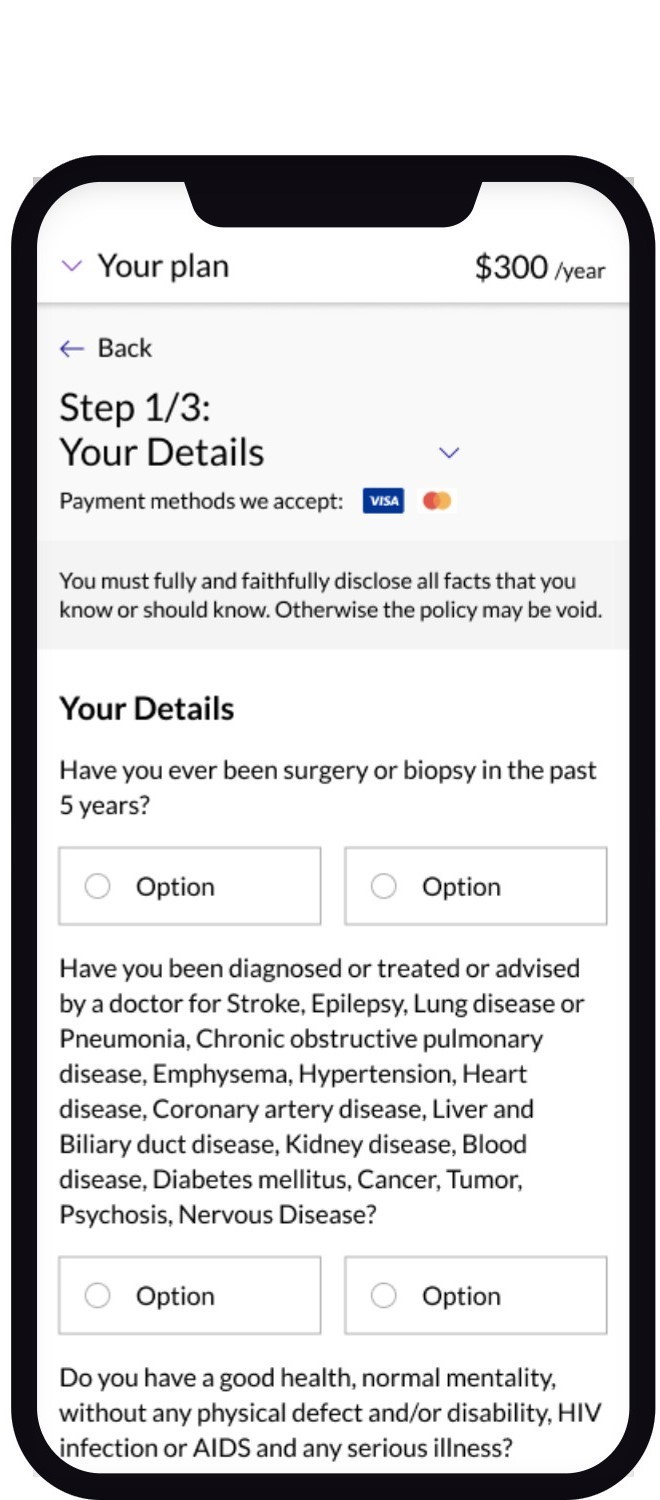

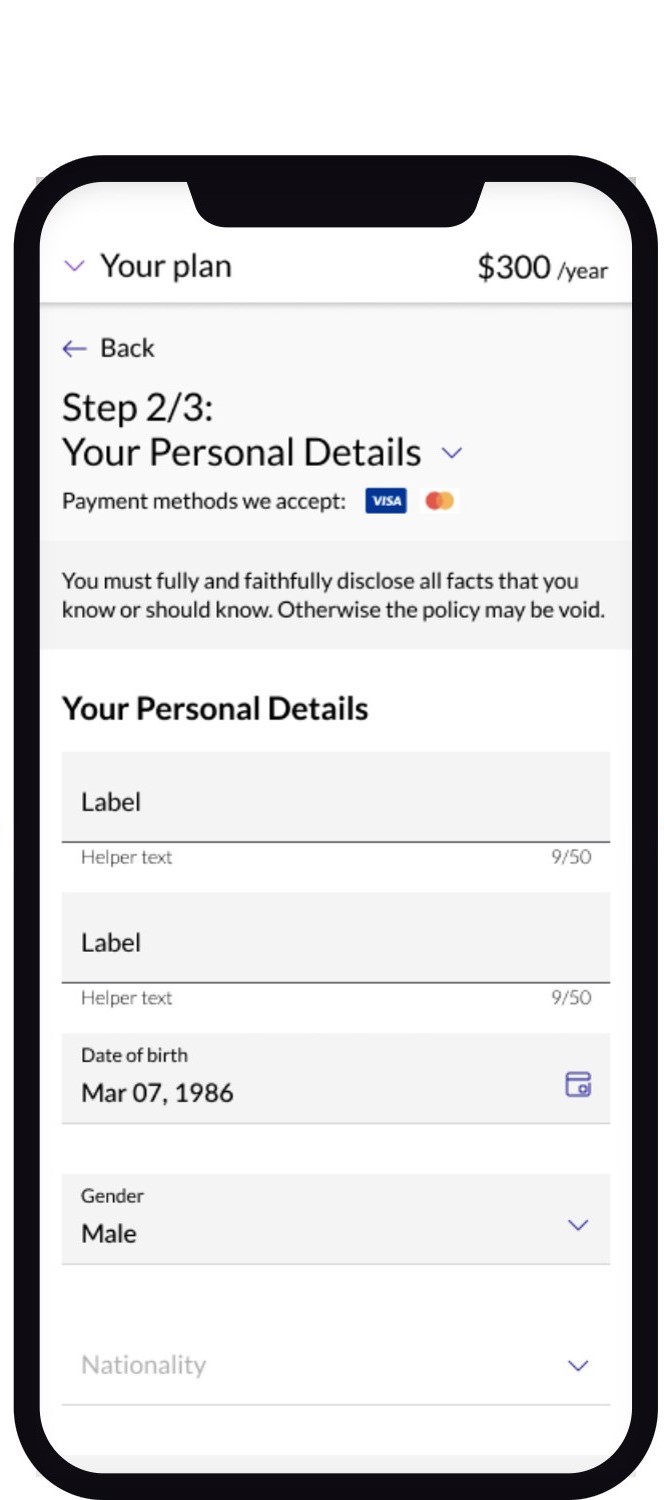

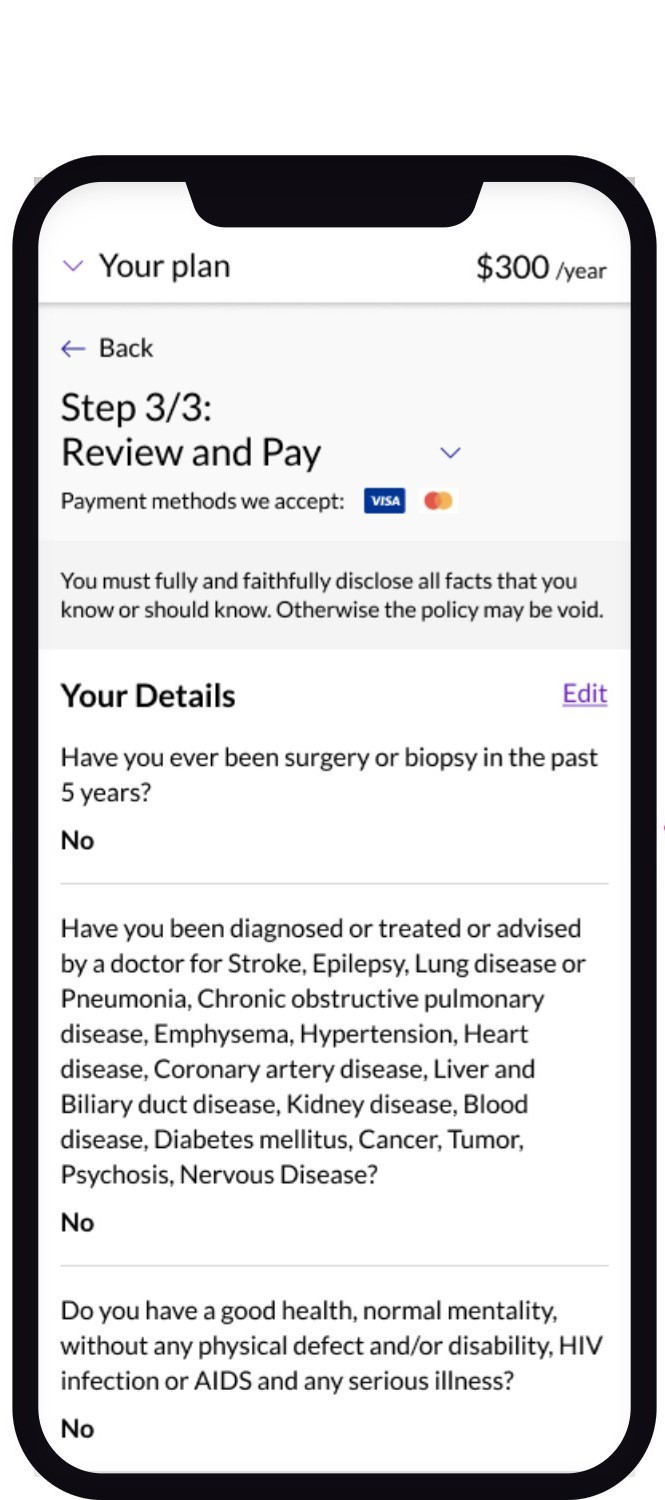

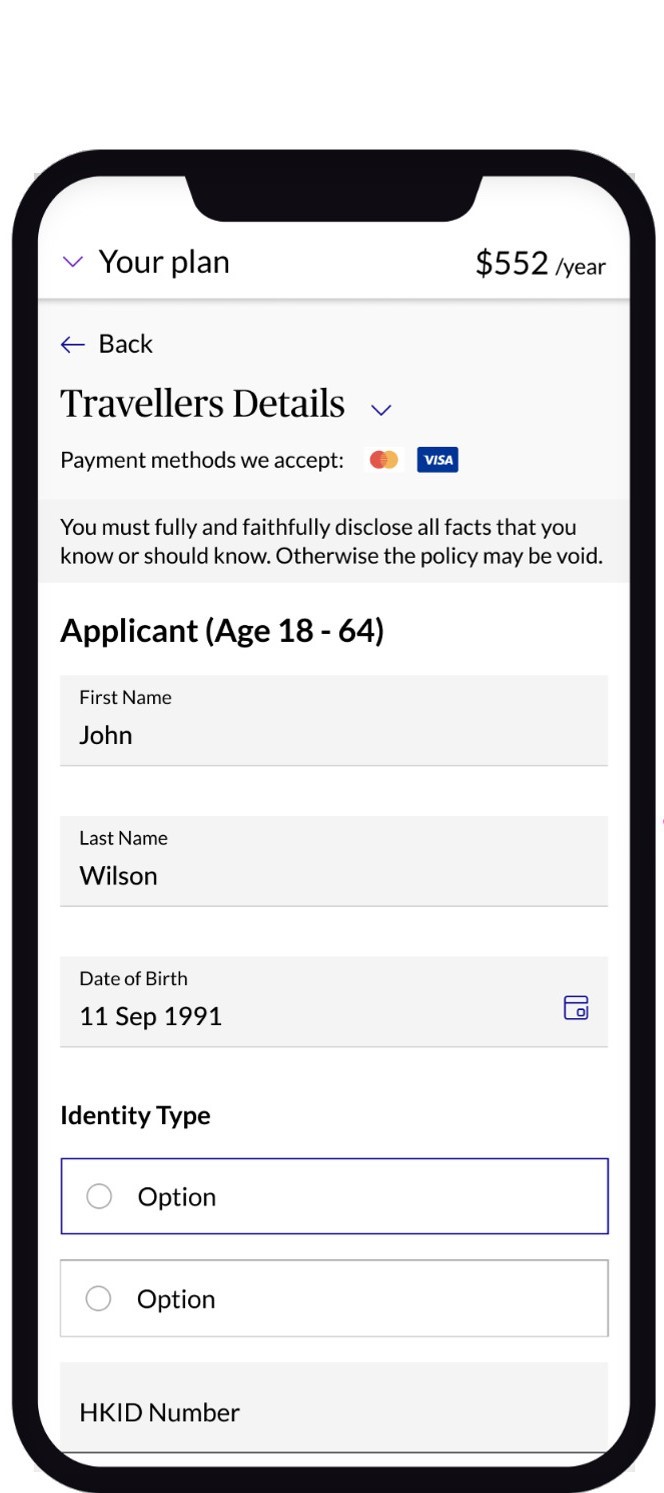

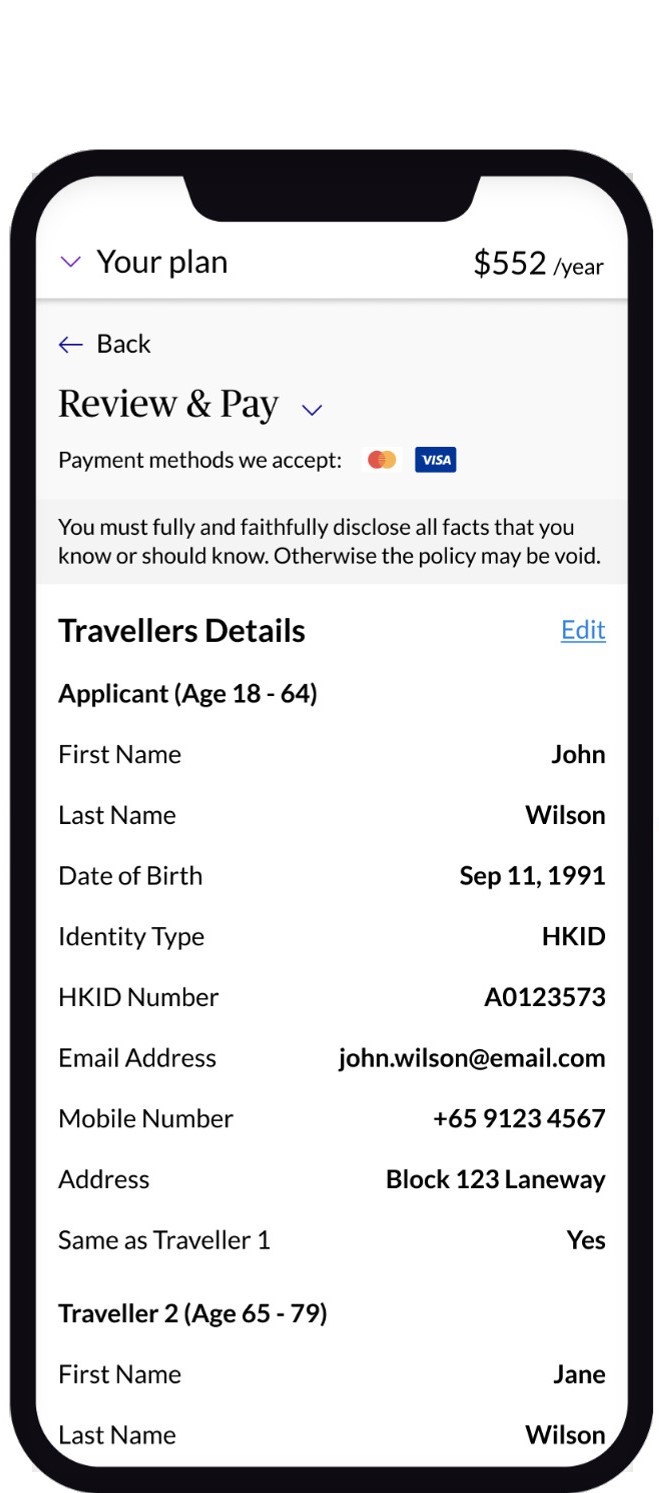

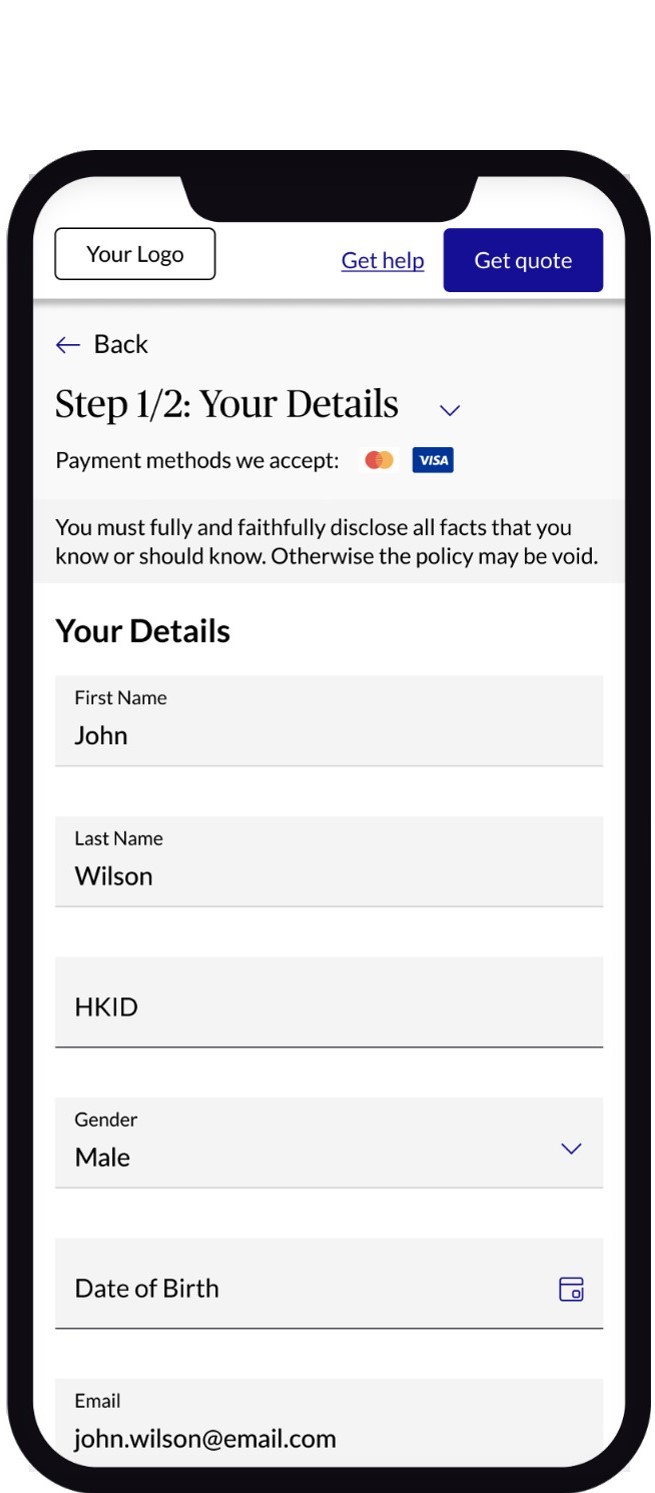

Provide the ability to capture, process, and submit a sale for a customer and issue an insurance policy.

What is the API value proposition?

- Enable a customer to purchase a policy for the coverages and services that meet their needs

- Revenue generating API that enables a partner to request, confirm, and submit a Chubb policy (with or without payment) for a customer

Payments

Payments

Provide the ability to manage payments for insurance products and services.

PCI compliant mechanisms to capture a customer’s account number and credit card information in a secure and compliant manner.

What is the API value proposition?

- Provide secure PCI compliant payment processing for insurance products and services. Caters to multiple payment methods/options ranging from credit/debit cards, bank debits, bank mandates, eWallets, Apple Pay, and Google Pay to cash settlements

- Support for the full payment life cycle (capture, void, authorize, settle, enquire) by making use of our integrations with various payment gateway providers across the globe

- Support various experiences, including deeply embedded partner branded experiences, Chubb hosted experiences, or payment gateway hosted experiences depending on partnership, local country, and product requirements.

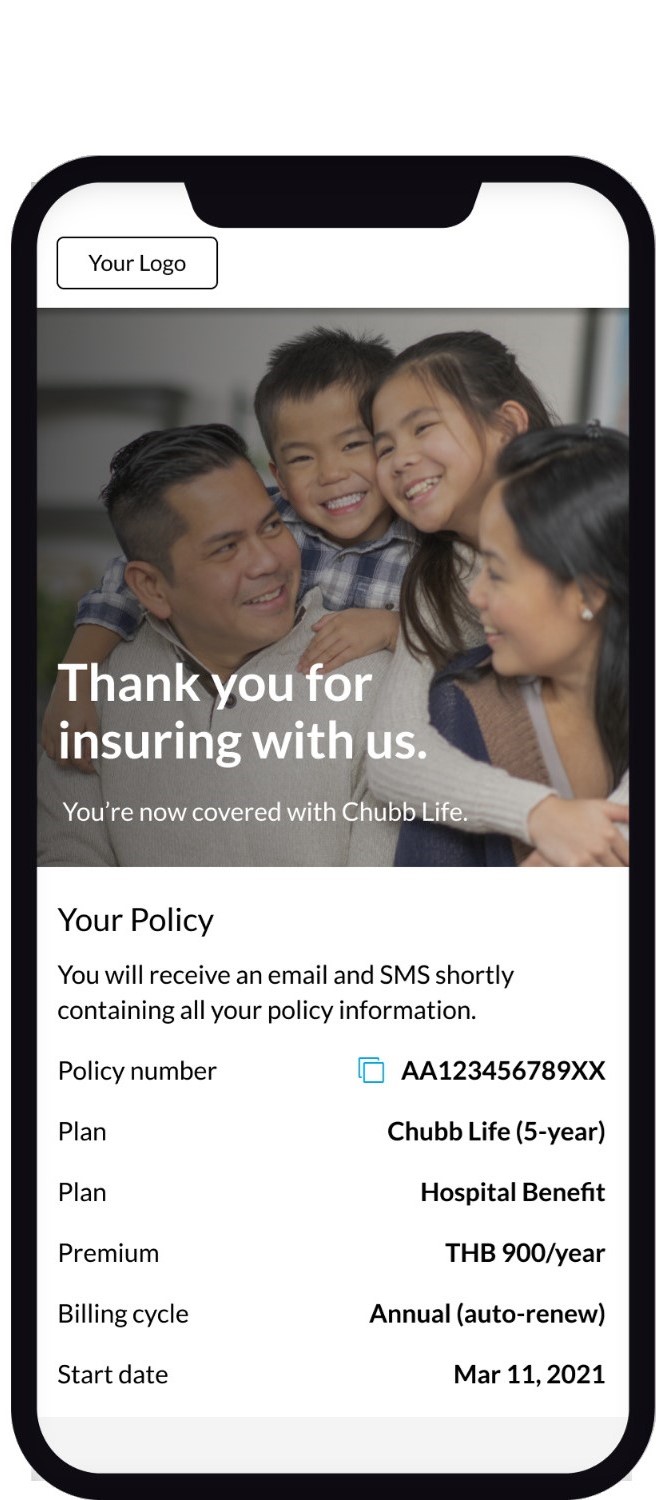

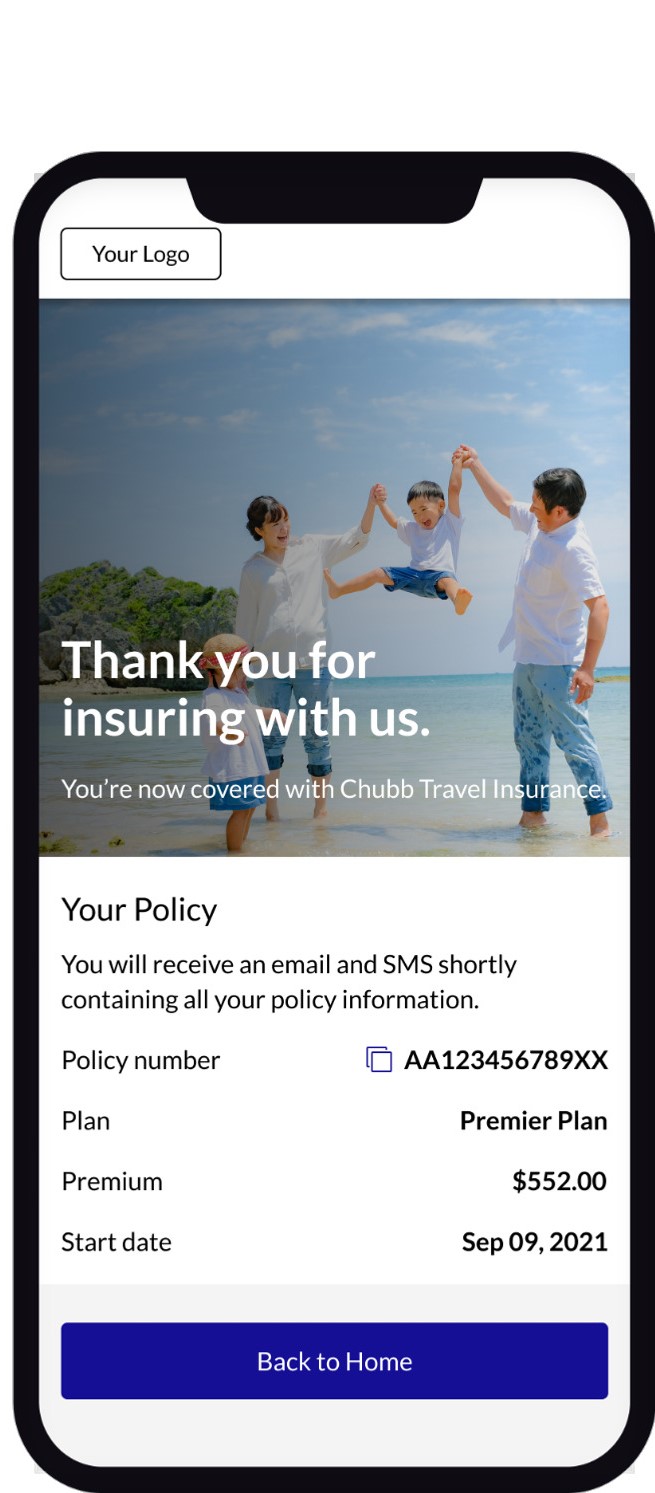

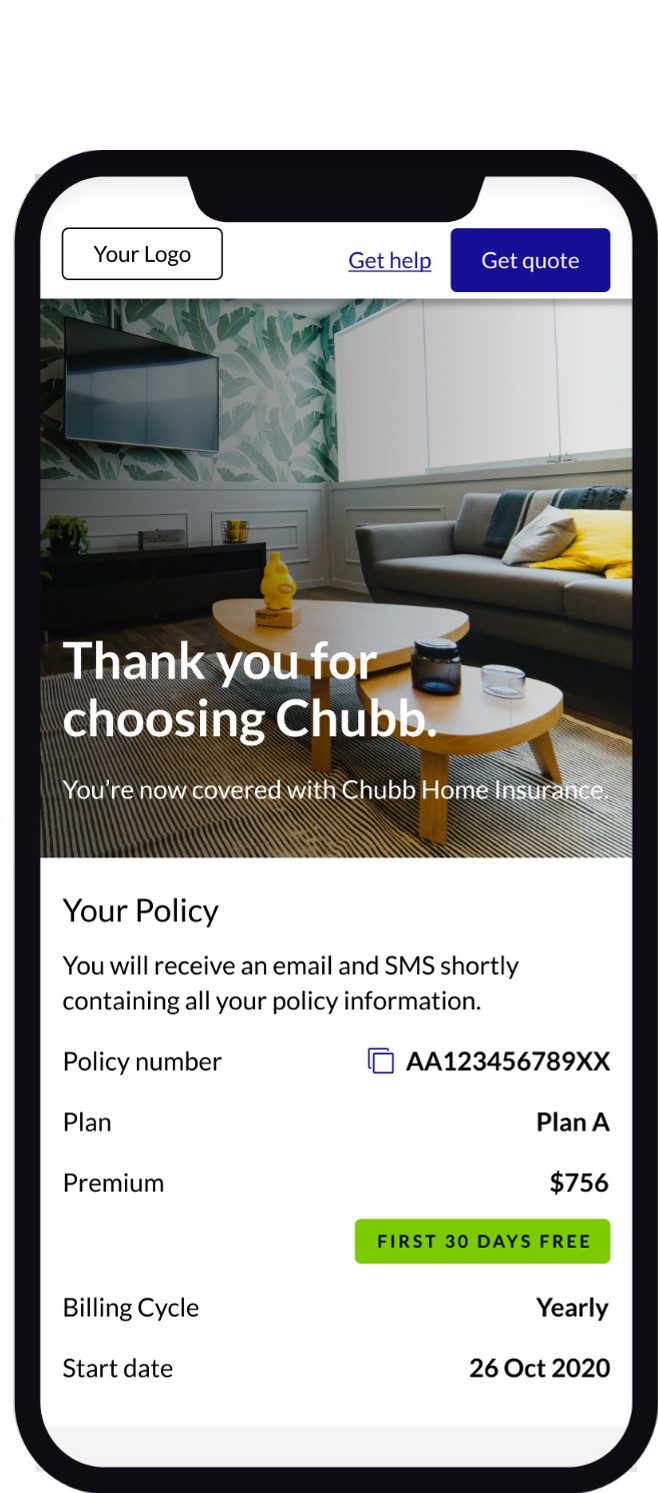

Fulfillment

Fulfillment

Provide a partner with the ability to request and/or instruct Chubb to send out fulfillment requests for policy documents across the policy lifetime. Examples of documents include Certificate of Insurance, Policy Wording, Additional Documents, Welcome Kit/Document, Product Factsheet, etc.

What is the API value proposition?

- Provide convenient capability to deliver policy documents to end customers

- Provide flexibility on the delivery methods for the documents – over the air/email/snail mail/ SMS

Servicing

Servicing

Provide the ability to facilitate customer and policy servicing requests such as customer/policy search, viewing a customer portfolio, viewing policy level details, and updating personal/policy details.

What is the API value proposition?

- Provide end-to-end insurance related services including policy servicing, customer servicing, and policy management

- Extend customer service channels, promote a consistent user experience across all channels, and streamline expenses by simplifying and automating policy servicing

Claims

Claims

Provide a partner with the ability to facilitate the submission of first notification of loss (FNOL)/claims for their customers and to track the status of claims already submitted.

What is the API value proposition?

- Fulfill the promise of Chubb’s world class claims experience by providing partners with an optimized channel to report an insurance loss on behalf of their customers and view the progress of a submitted claim

Utilities

Utilities

Provide a partner with additional capabilities to address custom requirements. These custom requirements can vary from partner to partner and utilities are provided with various tools to manage bespoke requirements like policy number generation, tax calculation, policy/payment/status webhooks, third-party APIs, etc.

What is the API value proposition?

- Provide the ability to manage bespoke and custom requirements based on partner needs

- Expand the capabilities delivered via APIs across third-party and other bespoke requirements

Metadata

Metadata

Provide a partner with metadata associated to needed for other APIs. This metadata caters for requirements around a list of values, dropdown values, currency labels, make models for gadgets/cars/motorbikes, occupation classes and codes, address lookups, country, state, district, and city listings.

What is the API value proposition?

- Provide the ability to manage metadata requirements of other APIs

- Provide standardized list of values/data across all attributes